Attention: Are you looking to buy or refinance your dream home at the best rate possible?

Discover how we help more than 20+ people, including Homeowners, First-time buyers, and Veterans, get the best options suited to their situation.

Even if you don’t have excellent credit or have a long work history, or your income doesn't seem to qualify, we can always provide you with the best options.

For over 15 years of lending experience, we’ve built a unique way to locate programs to fit client needs in less than 30 days.

✔ That saves you from legwork

Our connections with a wide range of lenders can help you score competitive interest rates & terms.

✔ Saves you time and Fees

Discover how we’ll find the best interest rate and lowest rate for you best suited to your situation.

✔ Finds the most advantageous deal

With our access to a wide range of mortgage options, we can provide you with the most excellent value in terms of interest rate, repayment amounts, and loan products.

✔ Delivers personalized service

Unlike others, We’ll help you smooth the way, always be available for you, and advise you with our knowledge throughout the process. In short, we will be your best friend.

✔ Fastens your loan process

Discover how we’ll help you complete the application and provide all income and savings at the point of application, approved in 2 days, and closed in 15 days.

And avoid these common errors people make when looking for a mortgage, like...

❌ Talking to only one lender

❌ Being careless with credit

❌ Overlooking FHA, VA, and USDA loans

❌ Miscalculating the hidden costs of homeownership

Take advantage of our FREE credit repair consultation or discover the best mortgage options for you today!

And get our exclusive free credit repair advice

Unlike many others, We are committed to making your Mortgage Process Seamless & Hassle-free.

Trying to find the lowest mortgage rate you qualify for is like googling your symptoms when you’re sick.

You want to find out your illness on your own, and you might get some general ideas about your situation by consulting Dr. Google.

Still, without seeing a real doctor who can perform an exam and maybe run some lab tests, your chances of getting an accurate diagnosis for your illness are pretty slim.

It’s the same thing if you’re looking for the best mortgage loan on your own without any expert.

You’ll get lost along the way, and finding a mortgage loan that fits your situation will be more difficult.

That’s the mission of SBS Mortgage Lending to help you get the best possible options and help you with the process and close your loan in less than 30 days!

Whether it’s Conventional, VA, FHA, or Down Payment Assistance.

You can book a free consultation call, discover how to fix your credit, and find the best mortgage option today!

And get our exclusive free credit repair advice

HI! I’M SHELIA SANDERS, A MORTGAGE LENDING EXPERT

I’ve been in the industry for 15 years, and I have a vast amount of knowledge and connections that help me & my client get the best possible mortgage deal and get it done in less than 30 days.

Rest assured that you can count on my dependability and accessibility. Whether a purchase or a refinance, you work with a highly skilled professional who strives for excellent customer service.

When you are ready to begin the mortgage lending process, I will be with you every step of the way to make sure that your loan closes quickly and smoothly.

My favorite part of the job is watching someone get excited to move into their new home. It is gratifying to know that I played such an integral role in helping them achieve their dream of homeownership.

How can we help you?

Refinance Without an Appraisal (no cash out)

One-time Close Construction Loans

We’ll make the financial process simpler for new home buyers.

There will be no re-qualification once construction is complete, making the process a lot simpler. Additionally, the Real Estate Agent gets paid during the closing, not after the house is finished.

This one-time closing reduces closing costs, saving you thousands of dollars.

If you have any inquiries, email us at: sempleebusiness@gmail.com

VA Programs-Veteran Friendly Company

Credit scores 500

IRRL( Interest rate reduction refinance loan)

Purchase Money

Down Payment Assistance

Minimum Score 580

Better Pricing 620

Up to 50% Debt-to-Income Ratio

However, even if you are eligible for DPA(Down Payment Assistance), you still must have your Appraisal and Earnest Money Deposit funds.

Schedule your free consultation call now, and discover what’s the best mortgage options suited for yours. Plus, get our exclusive free credit repair advice.

And get our exclusive free credit repair advice

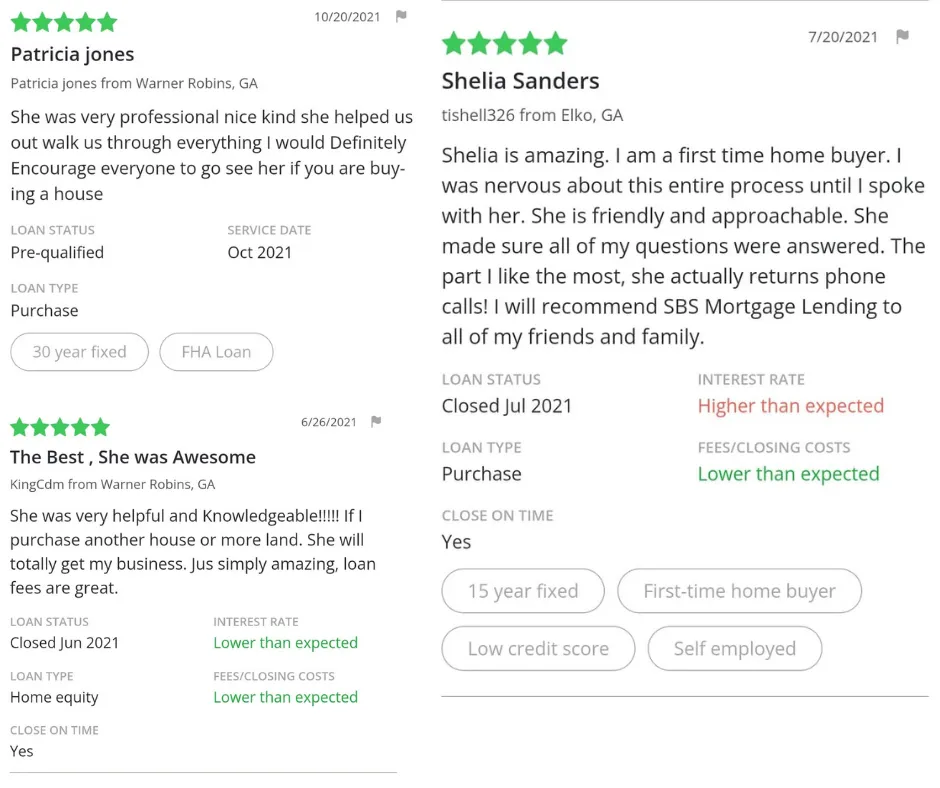

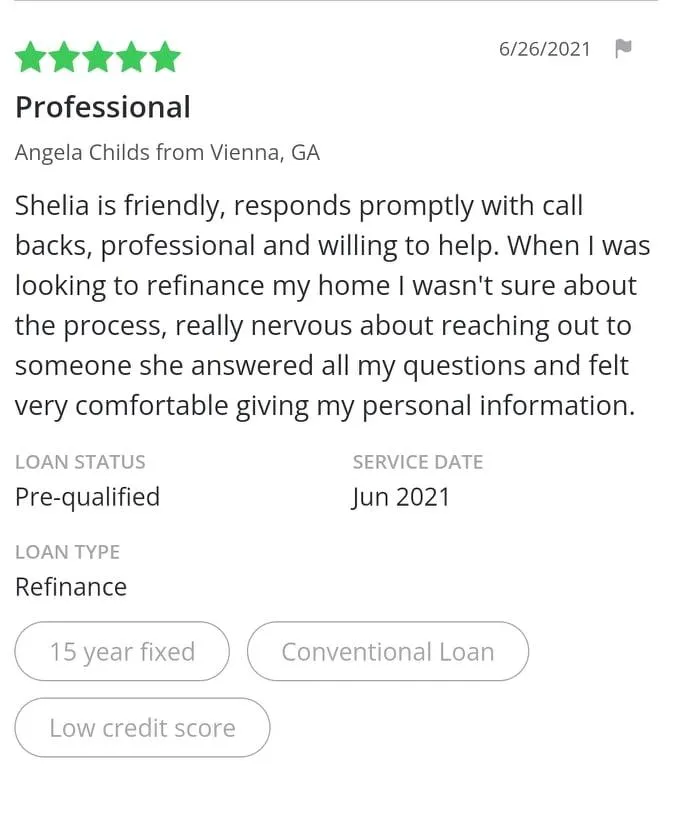

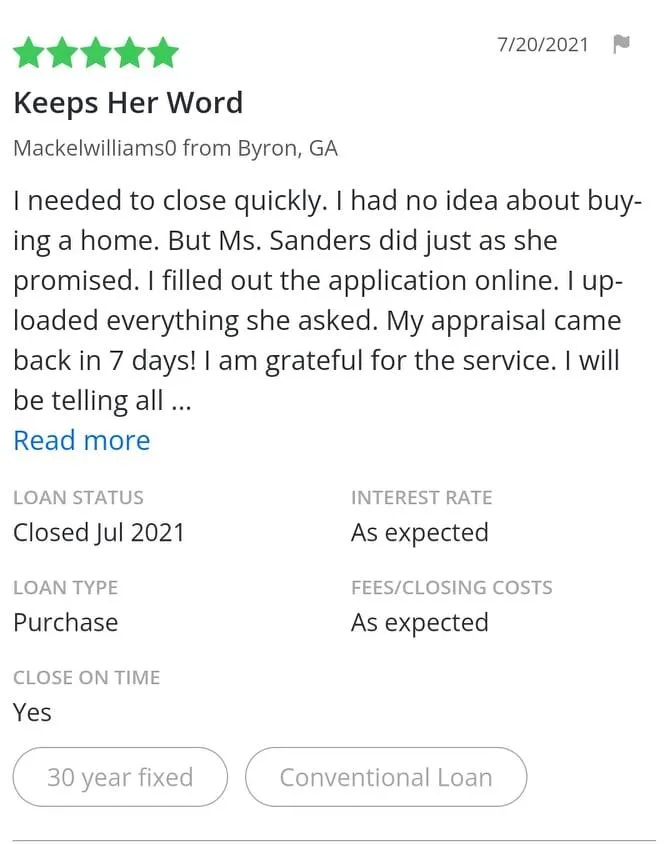

See what my Satisfied & Happy clients said about me...

And get our exclusive free credit repair advice

FAQs

1: How can I find out how much home I qualify for?

You can use our online prequalification tool to connect with a loan officer and find out approximately how much you can borrow before you start shopping for a house.

Once you have that number, you can provide more information and allow your loan officer to run your credit report to verify your assets and income.

Your loan officer can also help you obtain complete written credit approval, subject to an appraisal before you make an offer on the house.

2: Is there anything I shouldn’t do before I get prequalified?

Don’t start shopping for a new home until you’ve been prequalified.

Don’t pack or ship any essential documents, such as tax returns, bank statements, pay stubs, and W-2s.

Prequalifying for your home loan before you begin shopping for a house can save you hours of unneeded stress and heartache. When you know how much house you can afford in advance, you can meet your realtor, well-informed and ready to make an educated buy. In the eyes of a seller, a pre-qualified home buyer also appears more motivated.

Likewise, holding on to your paystubs, bank statements, and tax returns can make a speedy prequalification even speedier. Make all your bill payments on time to further grease the wheels and keep your loan process moving. It also helps to have a paper trail of any large deposits you make and notify your loan officer directly if you plan to use a down payment gift from your family.

*Avoiding these actions before and during the financing process can prevent unnecessary confusion.

3: Is there anything I shouldn’t do while getting prequalified?

Do not borrow any money.

Do not co-sign on a debt.

Don’t apply for new credit cards.

Prequalification can be easy, but it’s after you get preapproved and the loan process progresses that your lender may pull a refreshed credit report before closing to check for any new debt. So, any significant changes in your finances could delay your loan closing – or even result in denial despite a prior approval.

4: What are income and debt ratios?

Income ratio: Your total monthly housing expense divided by your pre-tax monthly income.

Debt ratio: Your total monthly housing expense plus any recurring debts, i.e., car payments, monthly minimum credit card payments, and other loan payments, divided by your monthly income.

Standard loan underwriting guidelines suggest a max 28 percent income ratio and 36 percent debt ratio, which may vary based on personal finances, loan program, and down payment.

While not taking on any debt and paying for everything with cash seems like a logical choice if you feel you can’t afford your lifestyle, no credit also means terrible credit in the eyes of a lender. In addition, there’s bound to be a time when you can’t buy something with cash, like buying a house (in most cases). So, we recommend opening at least three credit card accounts and making occasional purchases.

To manage your debt and maintain healthy credit, keep credit card balances to less than 30 percent of your credit limit. Also, don’t close long-term credit lines, even if they’re not being used. Your longest-standing credit card account might be a massive contributor to your credit score health — and the mortgage rate you qualify for.

5: What are cash reserves?

Cash reserves: The extra funds available to you after your loan closes.

These funds reflect your ability to make monthly mortgage payments, and different loan programs may have additional cash reserve requirements.

To estimate your ability to pay your monthly mortgage, we recommend setting aside about 28 percent of your monthly income—this number factors into your debt-to-income ratio mentioned above.

Any number between 25 and 32 percent of your income is manageable for many people. But, relying on a higher percentage of your monthly payment could put you at risk if you have a significant financial change, like rising insurance costs or loss of employment.

6: What is mortgage insurance?

This insurance helps protect a lender if a borrower forecloses on their property.

Borrowers pay for the mortgage insurance, allowing lenders to grant loans they might not have otherwise.

Mortgage insurance may be required on some loans when a down payment is less than 20 percent.

Likewise, selling one home and buying another means you might be able to protect the profits on the sale of your home, as long as it is used as a principal residence for any two of the last five years.

You could protect up to $500,000 in tax‐free profit when filing federal taxes jointly or $250,000 when filing single. This bonus of tax‐sheltering the earnings on the sale of your home may be available to you once every two years. Homeowners who take advantage of these deductions could save hundreds of dollars in annual taxes.

7: What are mortgage points?

Also called discount points, mortgage points work as a one-time fee you can opt to pay if you’d like to get a lower interest rate.

One mortgage point equals one percent of your total loan amount and may drop your interest rate one-eighth to one-quarter percent lower.

You may have noticed by now that lenders charge their fees, which can vary greatly. For example, one lender may waive a fee but add on another. Another lender might quote an interest rate before adding or subtracting discount loan points to change the total cost.

8: What’s an APR?

Annual Percentage Rate: Your total loan credit cost is calculated into a yearly interest rate called APR.

The APR includes loan points and other prepaid finance charges to reflect the accurate yield on loan, which is why the APR is typically higher than a loan interest rate.

To check that you’re getting the most competitive loan, you can compare “apples to apples” or APR to APR on different loan programs.

After you’ve applied for a home loan, you can expect to receive a Loan Estimate (mentioned above) from your lender. If you applied for more than one type of loan, LE would be broken down for each loan type. Then, IN THE COMPARISON SECTION, the APR for a loan will be listed on page 3 of the LE.

Most of the time, you’ll notice the difference between your APR and your loan interest rate right away. An APR is often higher than an interest rate because of added fees.

An APR is a comparison tool comparing multiple loan products. It can always be used to compare various loan products. In cases where an interest rate looks too attractive, the APR can tell you the real story.

You can use this handy trick to separate the good from the bad when choosing a mortgage: Compare a loan’s APR to its advertised interest rate. A noticeably higher APR than the interest rate may be a red flag in which the loan adds costs. Your loan officer can also help you compare and better understand loan fees.

9: Can I still get a mortgage if I have bad credit or have filed bankruptcy?

Having good credit helps get a more competitive mortgage interest rate, but perfect credit isn’t required.

If you have a low credit score or have filed bankruptcy in the past, you can work toward improving your credit.

Don’t let something as intimidating as a credit score keep you away from the information you’re entitled to. Checking your free credit report yearly, available from one of the three nationwide credit reporting agencies, can help you to keep tabs on your financial status — which becomes especially important when you’re buying a house.

Yearly credit checks can also help you catch any problems that pop up early on, like mistakes on your credit report or instances of fraud.

10: I just got a new job. How does this impact getting a mortgage?

Most loan programs are looking for a two-year job history in the same field — changing jobs to move to a better position could be seen as favorable.

For recent college grads, you may still be able to get a home loan without a two-year work history. Your school is counted as work. Congratulations, you are pre-approved.

If you’ve recently transitioned from conventionally employed to self-employed, you may need five more documents to complete your mortgage approval:

1099 for the last two years.

Form the 1120S or K1.

Both personal and business full tax returns for the last two years

Proof of self-employment.

Current balance sheet and profit/loss statement.

Borrowers with credit scores as low as 500 can qualify for an FHA loan with a 10% down payment. Guidelines and policies may vary by the wholesaler.-

Documents needed to qualify:

Photo ID

Verification of SS Number

2 months bank statements on all accounts

Confirmation of monthly income-2 check stubs bi-weekly payor four check stubs weekly pay.

Most recent W2’s (last two years)

Click here and apply for SBS mortgage lending. We’ll be assisting in making your loan process faster and hassle-free while getting the best deals suited for your situation.